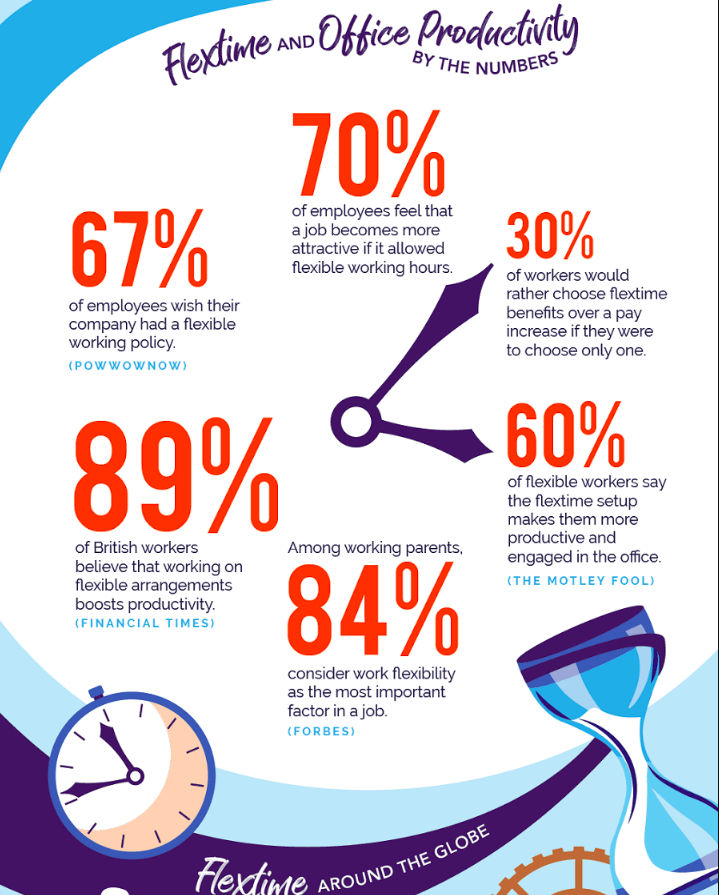

The vast majority in the USA die with some debt. Truth be told, 73% of shoppers had remarkable debt when they were accounted for as dead, as indicated by December 2016 information gave by credit authority Experian. Those shoppers conveyed a normal aggregate adjust of $61,554, including mortgage debt. Without home advances, the normal adjust was $12,875.

The information depends on Experian’s FileOne database, which incorporates 220 million consumers. (There are around 242 million grown-ups in the USA, as indicated by 2015 evaluations from the Census Bureau.) To decide the normal debt individuals have when they pass on, Experian took a gander at consumers who, as of October 2016, were not expired, but rather than appeared as perished as of December 2016. Among the 73% of purchasers who had debt when they passed on, around 68% had charge card parties. The following most normal sort of debt was home loan debt (37%), car loans (25%), personal loans (12%) and education loans (6%).

Table of Contents

These were the average unpaid balances:

| Credit cards | $4,531 |

| Car loans | $17,111 |

| Personal loans | $14,793 |

| Student loans | $25,391 |

What happens to debt after you pass away?

Generally, your debt dies with you, yet that doesn’t mean it won’t influence the general population you abandon behind.

Debt has a place with the expired individual or that individual’s domain. In the event that somebody has enough resources for cover their debts, the creditors get paid, and recipients get the straggling leftovers. In any case, if there aren’t sufficient resources for fulfilling debts, loan bosses lose. Relatives don’t then get to be distinctly in charge of the debt, as a few people stress they may.

Life Insurance Challenges For U.S. Emigrants

That is a general thought, yet things are not generally that direct. The sort of debt you have, where you live and the estimation of your bequest altogether influences the unpredictability of the circumstance. For instance, government understudy credit debt is qualified for cancellation upon a borrower’s demise. Yet private understudy advance organizations tend not to offer a similar advantage. They can pursue the borrower’s domain for installment.

It’s a certain something if the recipients are relatives that needn’t bother with your cash. Yet in the event that your recipients are a surviving companion, minor kids individuals like that who rely on upon you for their welfare. Then life coverage is an awesome approach to give extra cash in the domain to pay debts.

Instructions to avoid burden on your family

One approach to ensure debt doesn’t make a wreck of your estate is to remain out of it. You can watch your debts by assessing a free depiction of your credit provides details regarding the distinctive stage. Notwithstanding adhering to a spending that helps you live beneath your methods. You can consider getting life coverage and meeting with a bequest arranging a lawyer to ensure everything’s shrouded in the case of your passing. In case you’re stressed over abandoning debt after death, here’s additional on the most proficient method to secure your friends and family.

Financial Advisor or Financial Planner: Who’s Important?

“Lack of foresight can leave your friends and family with some noteworthy anxiety. For instance, on the off chance that you don’t have a will or assign recipients for your benefits. The law in your condition of living arrangement chooses who gets what.”

It can likewise get costly to have these matters dictated by the courts, and authoritative expenses get paid before loan bosses and recipients. In the event that you’d jump at the chance to accommodate your friends and family after you kick the bucket, you won’t need court costs and extraordinary obligations to destroy your home.