Donate your car to charity and get a tax break. It’s easy to Donate Car to Charity if all you want to do is getting rid of it. Simply call a charity that accepts old vehicles.

Permitting taxpayers to reduce the full honest incentive for each one of those gave vehicles cost the IRS a ton of dollars, nonetheless, so the organization fixed the guidelines. Today, you can just deduct a vehicle’s honest incentive under particular conditions. Will walk you through those conditions, with the typical stipulation that you ought to talk about these issues with your duty prepare before you act. Additionally take note of that if your state or region likewise demands pay charges, different standards may likewise apply.

Table of Contents

How Car Donation Tax Deduction Works

The IRS was permitting individuals who gave to a qualified car gift program to take a duty reasoning in light of their vehicle’s fairly estimated worth regardless of how much or how little the vehicle sold for” in January 2005. Deciding the market estimation of gave vehicle is frequently very troublesome and tedious, which made assurance of the measure of the expense conclusion befuddling. Luckily, thus of the new expense law that became effective in January 2005, the IRS has removed the mystery from deciding the estimation of your gave auto, truck, RV, watercraft or other vehicle.

You Must Itemize Your Return

In the event that you need to claim equitable tax deduction for your car donation to diminish your government salary charges, you should separate reasoning.

Here’s the math: Suppose you are in the 30 percent impose section. Your car’s value, and along these lines the reasoning, is $1,100. “The $1,100 finding will spare you $380. In case you’re in the 17 percent assess section and you give a car worth $1,100, it will just lessen your expenses by $187.

In the event that rather you take the standard finding, which in 2012 was $6,950 for a solitary individual or $12,900 for a wedded couple documenting together, you spare a large number of dollars over recording an organized return just for the motivations behind specifying your auto gift.

The main way that giving a car nets you any tax reduction is whether you have numerous findings, and if their aggregate whole, including the auto, surpasses your standard conclusion.

The most effective method to Deduct Fair Market Value

These are the four IRS governs under which you can get the most extreme conclusion (the equitable value) of a car donation:

- At the point when a charity auctions your car for $600 or less, you can assert either the equitable value or $600, whichever is less?

- At the point when the charity plans to make a “critical mediating utilization of the vehicle.” This implies the charity will utilize the car in its work, for example, conveying dinners to destitute individuals.

- At the point when the charity plans to make a “material change” to the vehicle, which is “anything that expands the car’s value and drags out its life. It can’t be a minor repair or upkeep; it must be something like settling the motor or frameworks that run the auto.

- At the point when the charity gives or offers the vehicle to a destitute individual at a cost altogether beneath honest value, and the blessing or deal is a piece of the philanthropy’s central goal of helping the penniless who require transportation.

Step By Step Instructions to Determine Fair Market Value

To recap, the IRS characterizes honest incentive as the value an eager purchaser would pay and a ready vender would acknowledge for the vehicle, when neither one of the parties is constrained to purchase or offer nor both sides have sensible learning of the important realities. Neither the purchaser nor the merchant can be a car merchant. Both must be private gatherings.

- Getting Fair Market Value Is Rare:

It’s not practical to expect that your auto will meet a standout amongst the most stringent equitable esteem necessities. Take it from 1-800-Charity Cars, which says it is the biggest way to donate car to charity in the United States. It grabs gave vehicles from the nation over and gives whatever number of the cars as could be expected under the circumstances to individuals who require transportation. As indicated by the philanthropy, few gave autos are appropriate to provide for the general population it serves.

- Another Approach to Car “Gift” :

Other than giving Donate Car to Charity, there is another way your vehicle can help a charity and furthermore augment your tax breaks: You can offer the vehicle yourself and give the returns.

- On the off chance that the qualified association will offer the vehicle with a specific end goal to get money, then it would bode well for a person to offer the vehicle to a private gathering to augment the measure of money continues.

- On the off chance that you will probably boost your assessment derivation, painstakingly audit the means here and after that settle on your choice. Whatever you take to do, separating with your old car could help a charitable complete its main goal. Furthermore, it likewise may make room in your carport for another car.

Tips

If you want to donate your old car, take these steps to help ensure the proceeds go to good works and that you’ll get a bona fide tax deduction:

- Checking Out a Charity

- Check how much goes to good works

- Make sure the charity is legitimate

- Donate the car directly to the charity

- Knowing The Write-off Rules

- Value your car correctly

- Make sure the title is signed over to the charity

Warning

You must have documentation of your gift. At the very least, the documentation you get from the philanthropy must incorporate your name, the vehicle ID number, the date of your gift and an announcement depicting the products and ventures you got, assuming any.

Related Post:

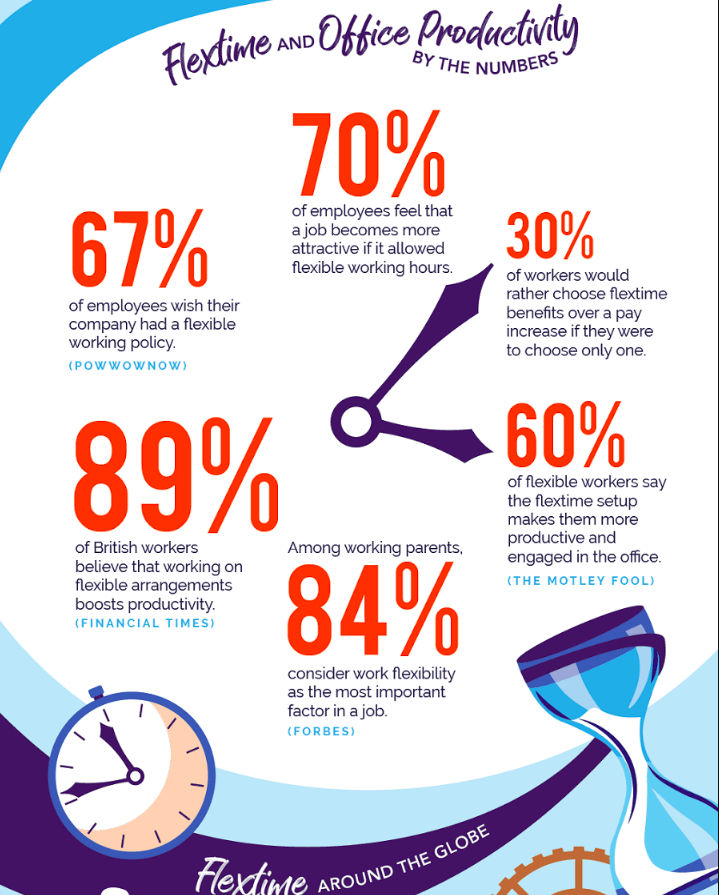

Creative Ways to Attract and Retain Top Employees

A happy employee is a productive employee. You can help your staff feel comfortable and valued in so many ways – and not just with a pay raise. Increasingly, individuals are looking for work that offers them a fantastic benefits package that keeps them feeling motivated. By implementing a few simple practices, you could increase…

6 Work Culture Trends We’re Looking Out For in 2021

The pandemic has changed everything, quite literally everything. While we’re sure you already have a great work culture in place, the COVID-19 pandemic has changed everything in the business world, including the worker-employer relationships. For organizations focusing on work culture, the shift to remote working means creating new strategies to support employees, manage a hybrid…