The finance related world is loaded with confounding acronyms and titles, and it appears everybody touting financial advice has a heap of puzzling assignments after their name. A standout amongst the most generally utilized titles is financial adviser OR Financial Advisor. This name is risky in light of the fact that it is nonexclusive and completely excessively expansive.

Stockbrokers, venture counsels, bookkeepers, brokers, Insurance agents and even some lawyers frequently allude to themselves as financial advisors. The term is expansive to the point that it regularly covers any zone of monetary help. Sadly, there is no administrative direction or principles for utilizing such a title. In this way, when you employ a money related guide, you ought to likewise get some information about any regions of specialization. You may find that on the off chance that you need to contract somebody who charges an expense for financial advice, your protection operator — who calls herself a financial advisor or Financial Planner— won’t have the capacity to help you.

While financial advisor is a general class, a financial planner — particularly a Certified Financial Planner (CFP) — has practical experience in giving extensive money related arranging administrations (Full revelation: I am one). In truth, your money related organizer may likewise offer budgetary items like protection or ventures; however the key contrast is he readies an extensive composed financial plan.

While you don’t generally need to work with planner on a continuous premise, there are times when it bodes well to stop in for some financial advice and consultation:

- When you get a large sum of cash

Getting a substantial aggregate of cash, for example, from a legacy, reward, buyout or enormous raise, ought to be a shelter to your financial health. Sadly, many individuals have a tendency to misuse the open door for financial advice that it presents. Notwithstanding the measure of your godsend, meeting with a financial advisor can guarantee you put the cash to great utilize.

- When you are justified regardless of a quarter million

In a large portion of the above cases, you may just need to pay for a solitary visit with a financial adviser, or continuous paid financial advice may not be important. Be that as it may, once your salary and resources achieve a specific point, you might need to build up a general working association with an organizer who can hold you under control. As per some monetary specialists, a quarter million in resources is a decent time to step far from your ventures and let a target outsider stride in.

- When you land your first job

It doesn’t make a difference whether it pays $10,000 a year or $100,000 a year, your first employment is a justifiable reason motivation to check in with an expert Financial Advisor Or Financial Planner. Not exclusively would they be able to exhort on how best to start putting something aside for retirement, they may likewise give understanding on the most proficient method to augment your boss’ advantages bundle.

- When you get married or separated

Another great time to search out proficient financial advisor: at whatever point you enter or leave a marriage. Getting a fair outsider can help limit financial losses in a separation and may make it simpler for connected with couples to have discussions about joining resources and pay in marriage.

- When you are plan retirement

Retirement arranging is one range where financial planners sparkle. Be that as it may, to benefit as much as possible from their recommendation, you have to counsel with Financial Advisor well before your normal quit date.

Related Posts:

Table of Contents

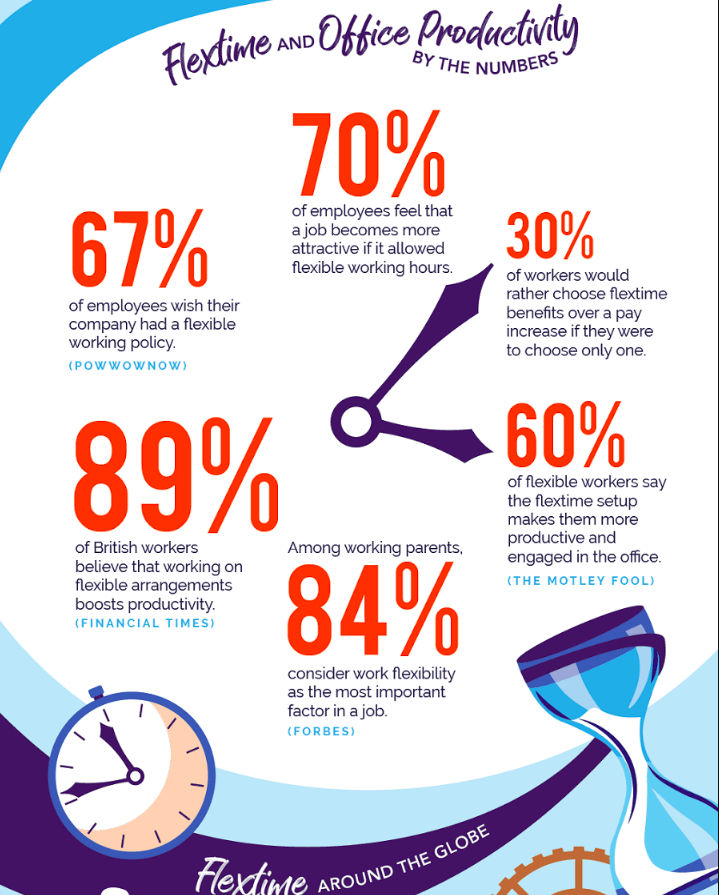

Creative Ways to Attract and Retain Top Employees

A happy employee is a productive employee. You can help your staff feel comfortable and valued in so many ways – and not just with a pay raise. Increasingly, individuals are looking for work that offers them a fantastic benefits package that keeps them feeling motivated. By implementing a few simple practices, you could increase…

6 Work Culture Trends We’re Looking Out For in 2021

The pandemic has changed everything, quite literally everything. While we’re sure you already have a great work culture in place, the COVID-19 pandemic has changed everything in the business world, including the worker-employer relationships. For organizations focusing on work culture, the shift to remote working means creating new strategies to support employees, manage a hybrid…