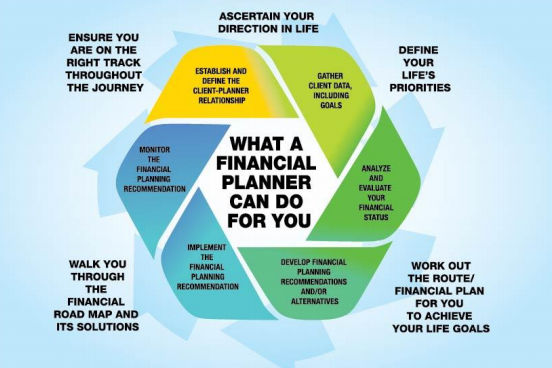

Picking UP the right Financial Planner is staggeringly essential. You’re choosing the individual will’s identity accountable for your cash and who (you expectation) will profit become throughout the years. Hire the wrong financial planner, and you could wind up spending your brilliant years attempting to ruin by.

There are plenty of components to consider when looking at planners. However the principal thought ought to be the affirmations they hold. A prestigious affirmation doesn’t ensure that a planner is at the highest point of their field. Yet it means they’ve demonstrated their skill in no less than one part of money related arranging. In this manner, recognizing what the diverse confirmations mean can help you limit your choices to organizers who spend significant time on subjects that are pertinent to you.

Table of Contents

Financial Planner

Many investors assume that any professionals who refer to themselves as “financial planners” have received some kind of certification. You’re better off sticking with financial planners who have an actual certification by a governing agency, be it state or federal.

Numerous investors expect that any experts who allude to themselves as financial planners have gotten some sort of accreditation. Lamentably, there’s no administer representing who can pass the title of the monetary organizer. Anybody can set up shop utilizing that title, regardless of whether they know anything about back or have any understanding. You’re in an ideal situation staying with financial planners who have a genuine accreditation by an overseeing organization, be it state or government.

How The Rich Taxpayers Utilize Their IRAs

Investment Adviser

These financial planners are in the matter of giving counsel about securities (yet not normally different sorts of ventures) to their customers. Numerous venture guides are likewise enrolled delegates, however, the two titles don’t mean a similar thing. Venture guides are required to enlist with the SEC (if overseeing $110 at least million in customer resources) or with the state securities controller (if overseeing under $110 million), so they may allude to themselves as enrolled speculation consultants, or RIAs. Like stockbrokers, venture counsels are typically more centered around offering than on promoting, and the way that they are prepared just to give the exhortation on securities implies they aren’t probably going to consider different sorts of speculations.

How to reduce Tax Burden?

Chartered Financial Analyst (CFA)

The CFA assignment is conceded just by the CFA Institute. To pick up this confirmation, counsels must meet noteworthy instruction and work encounter necessities and pass a progression of three exams. CFAs have mastery in speculation examination and portfolio administration, and they’ve likewise demonstrated. That they’re not kidding about acting their art since time is running short and exertion required to accomplish this accreditation. In any case, while proceeding with training is prescribed by the CFA Institute. It’s not required, in this manner, a CFA could possibly fall outdated. Before procuring a CFA, you may wish to get some information about their proceeding with instruction endeavors.

Annuities: Guaranteed Income But Pays Some Price

Certified Financial Planner (CFP)

The CFP accreditation is offered by the CFP Board and considered the highest quality level affirmation for money related organizers. CFPs meet stringent instruction and experience necessities, finish a board-enrolled training program, and are required to take proceeding with instruction once affirmed. They should likewise submit to the Board’s Standards of Conduct. Which comprise of a code of morals, principles of lead, and practice measures. CFPs are dependably trustees, which means they are lawfully required to put their customers’ advantages in front of their own under all circumstances.

Which one would be advisable for you?

For most investors, a CFP would be the best decision, trailed by a CFA. Somebody who needs a consultant with solid assessment arranging or other bookkeeping related abilities ought to consider a PFS. Money related organizers with whatever other assignments (and there are hundreds) are held to significantly less stringent training and experience necessities, assuming any, and are additionally more averse to hold themselves to guardian principles. Given that you are setting your budgetary life in this present individual’s hands. You’re in an ideal situation staying with somebody who has demonstrated that their insight and capacity.