In case you’re searching for an ensured stream of salary all through retirement, then an annuity might be the best alternative for you. Annuities offer lifetime wage, assess deferral, and numerous different advantages that can make your retirement fiscally secure. Be that as it may, there’s no such thing as a free lunch. Before you consider purchasing an annuity, you ought to comprehend what those advantages and certifications will cost you.

The valuation of security

Be that as it may, this payout ensure includes some major disadvantages. As an end-result of giving ensured pay that depends on a theoretical sum, the annuity contract will charge a yearly expense to all financial specialists who decide on one of these ensured salary riders, and this sum will be drawn from your real contract esteem. This will viably diminish the real give back that you acquire in the agreement after some time and can abandon you with generously less in your agreement than you may have on the off chance that you didn’t choose to convey this rider. For instance, F&G’s agreement specified above conveys a cost of 1.05% every year. This implies if your agreement really developed by 6.05% for the year, then the genuine development after the rider expense is paid would abandon you at 5% for the year. The ensured rate of development in the annuity contract, in this way, comes to the detriment of the genuine measure of development in your agreement after some time. Hence, much of the time, the theoretical measure of development that is guaranteed in the rider is generally what is utilized to compute your annuity payout at retirement. You will, in this manner, need to choose whether you are glad accepting a payout based upon this theoretical rate of development before buying one of these riders, as the chances are this is the rate of development that will be utilized to process your payout at retirement.

Ensured pay riders

One of the key components that many ordered and variable annuities now offer is called a wage advantage rider, or living advantage rider. This rider will furnish you with an ensured payout that is based upon a speculative rate of development guaranteed by the disaster protection transporter. For all useful purposes, your annuity will then have two qualities. One esteem is the genuine estimation of the agreement, which will rely on the measure of intrigue that is credited to your annuity in the event that you claim a listed contract, or on the consolidated estimation of the basic shared store subaccounts in the event that you possess a variable contract. The other estimation of your annuity is the speculative sum that your agreement would develop to base upon the rate of development guaranteed by the rider.

“When you annuitize your agreement, the payout you get will be figured based upon this speculative sum rather than the genuine esteem that your agreement developed to amid that time. Be that as it may, if the real contract esteem happens to surpass this speculative sum at the time you are prepared to start taking withdrawals, then your payout will be based upon that sum. Your payout will dependably be founded on the bigger of these two sums.”

Keep in mind

- Annuities can furnish you with a lifetime stream of pay based upon an ensured rate of development yet this sort of wage assurance does not desire free.

- Remember that the yearly charge (for this situation, 1.05%) is just deducted from your real contract esteem; the rate of development under the rider is the full 7%. In any case, keeping in mind the end goal to get a payout that is based upon this assurance, it is important to annuitize the agreement, which irreversibly changes over the agreement from a development vehicle to a payout vehicle. You will then get an ensured stream of pay from the agreement for whatever is left of your life (or the length of possibly you or your companion lives, on the off chance that you select a joint life payout). Be that as it may, in the event that you or potentially your life partner doesn’t live sufficiently long to recover your key, then the insurance agency will keep the distinction.

- Ensured pay riders and living advantage riders can be fairly perplexing in nature, and a few guidelines must be followed so as to appropriately receive their rewards. Counsel your budgetary counselor or protection operator for more data on these riders and how they can profit you.

Related Post:

Table of Contents

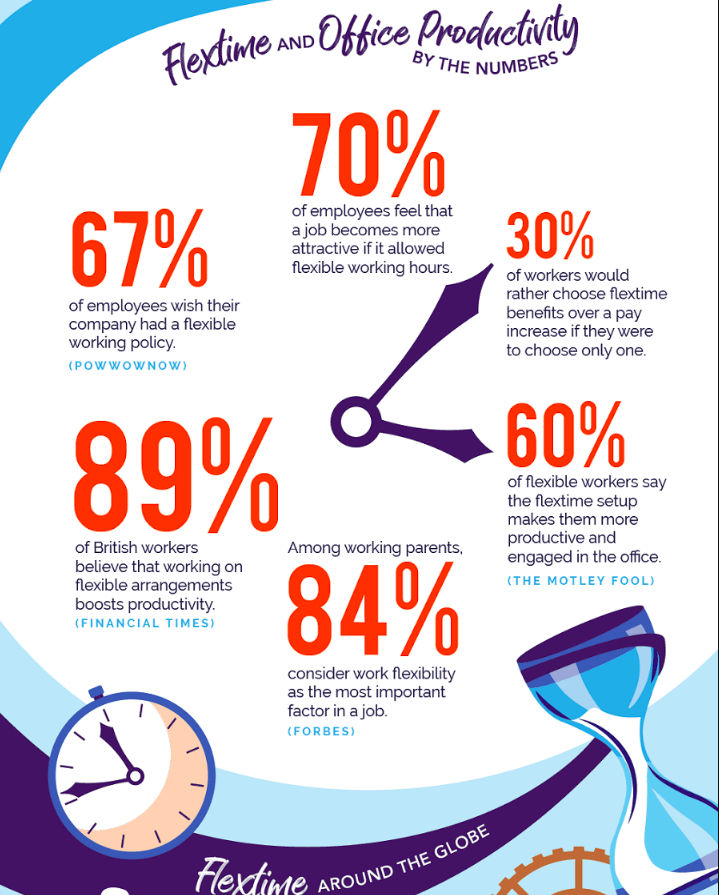

Creative Ways to Attract and Retain Top Employees

A happy employee is a productive employee. You can help your staff feel comfortable and valued in so many ways – and not just with a pay raise. Increasingly, individuals are looking for work that offers them a fantastic benefits package that keeps them feeling motivated. By implementing a few simple practices, you could increase…

6 Work Culture Trends We’re Looking Out For in 2021

The pandemic has changed everything, quite literally everything. While we’re sure you already have a great work culture in place, the COVID-19 pandemic has changed everything in the business world, including the worker-employer relationships. For organizations focusing on work culture, the shift to remote working means creating new strategies to support employees, manage a hybrid…