In reality, utilizing “other individuals’ money” isn’t an awful thought, however truly there are mix-ups you will need to stay away from on the off chance that you utilize this strategy for build Business Credit fast.

Begin off on the correct foot and manufacture a Business Credit Rating as quickly as time permits. Something else, even a set up business may think that it’s difficult to get credit in the organizations name and keep away from individual certifications.

While a couple new companies are sufficiently fortunate to either develop debt free or get bunches of Investment Capital, most independent business will borrow. Also, ordinarily they will depend at first on founder’s credit cards or personal credit.

Try not to Neglect Personal Credit

While building up a solid Business Credit Rating is vital, don’t ignore your personal credit rating. By and large, in any case, it’s vital that private business has both great business credit and in addition strong personal credit, with respect to the founder. Try not to neglect one to the expense of the other.

With appropriate arranging, you can assemble a solid business and personal credit ratings, and have the best of both universes!

Get Business Credit, Not Personal Credit

Regardless of the possibility that you should give an individual guarantee, business credit can be desirable over utilizing personal credit. Numerous business credit cards and loans are not provided details regarding your personal credit report, and this implies your credit rating won’t be influenced by the measure of debt you are conveying to back your business.

Keeping your business and personal credit separate can likewise help you abstain from passing up a major opportunity for important tax deductions.

Set up a Proper Business Structure

Before you attempt to start, set up the best possible structure. There are a lot of motivations to abstain from business together as a sole proprietor, and the capacity to build up a corporate credit profile as a different substance is another.

Get Listed

Once you’ve framed your corporate structure, the initial step is not to apply for a credit! Truth be told, before you begin rounding out applications, you will need to find a way to guarantee your business seems stable to the announcing organizations. That implies getting the best possible word related licenses, and a telephone number that is recorded with catalog help with the business’ name, in addition to other things.

Try not to Let Credit Ratings Get Personal

Business credit ratings are altogether different personal credit ratings in some key ways. Generally they are additionally totally isolated, however there are business credit scores in light of both the danger of the business and the personal credit of the proprietor of the organization.

Business credit ratings are not secured by credit reporting laws the way personal credit scores are. Oversights can be hard to the right, so it is basic to build up business credit accurately the first run through.

Utilize Business Credit Cards

Business Credit Cards can be an awesome tool, however be watchful about storing up a lot of credit card debt, particularly on one card, where you are powerless against the impulses of the credit card organization.

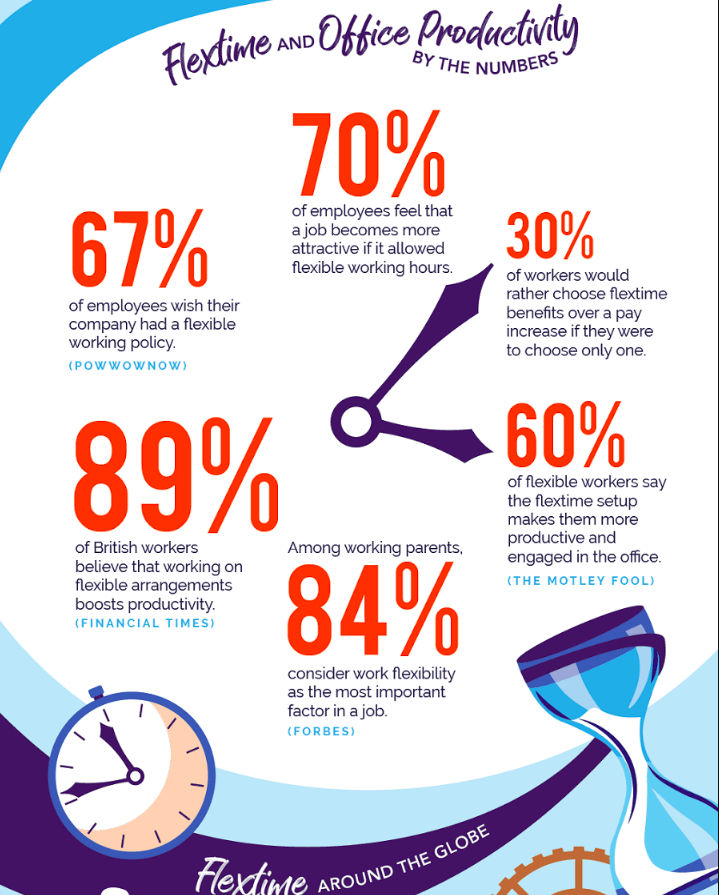

Create a Paper series

When you have built up your organization as an honest to goodness endeavor, you should purchase items and services from organizations that will report your payment history to the real business credit reporting firms. While personal credit rating depends to a great extent on how you handle your payments on credit cards and different sorts of advances, business credit ratings can be worked with “exchange” credit. Different elements, for example, the industry your business is in, and even the condition of your nearby economy can calculate a portion of the business credit ratings.

Read Loan policy carefully

When you do obtain, ensure you focus on the cost of your loans. In the event that you are utilizing business credit cards, for instance, give careful consideration to your interest rate.

Table of Contents