Numerous Americans don’t utilize money related organizers for all the wrong reasons. Some don’t think they have enough cash concealed. Others don’t know where to begin. Actually, half of Americans don’t know where to turn for financial exhortation. Furthermore, 20 percent say they have no clue the amount they requirement for retirement.

All that clarifies why the vast majority of us have spared so little for retirement. In any case, as I say constantly, it’s never past the point where it is possible to begin.

Here’s something to make them go. In the course of recent months, as we’ve perused to many money related guides, for their best retirement tips to impart to per users. So here you go, without a moment to spare for the new year:

Jennifer Landon, author of Journey Financial Services, Ammon, Idaho

“In our office, we come at ¬retirement arranges with a two dimensional arrangement. There will be an arrangement to give the required salary — the cash customers need to pay their regular bills. We will treat that cash in an unexpected way. We need it to be unsurprising. We need it to have significantly less market hazard. In the event that we can put ensures around salary, we will. Everything past that, whatever that number is, well beyond the requirements, is the place we will go for broke attempting to build the general retirement fund, since we can’t anticipate the market. We can’t foresee what loan fees will be. In the event that we manufacture ensures about pay, we don’t need to depend on variables we can’t control to ensure your retirement is sound.”

David Fleisher, president and CEO, Firstrust Financial Resources, Philadelphia

“Begin sparing and don’t stop! The sheer demonstration of reliably sparing into a sensibly adjusted portfolio after some time is the absolute most capable stride toward ¬financial security. As you get nearer to retirement, don’t get baited into ‘one-dimensional’ techniques, for example, ‘put resources into all stocks and live off the profits,’ or ‘purchase all munis.’

“Fruitful retirement pay arranging depends on taking a ‘multi-dimensional’ approach, which joins conventional portfolios (profit paying stocks included), ensured ¬income sources, (for example, Social Security, benefits and annuities) and significant fluid bank investment funds. By utilizing diverse methodologies, retirees have more devices to explore through head winds amid retirement, which could most recent 30 years or longer.”

Jeanne Thompson, senior VP, Fidelity Investments, Boston

“Begin as ahead of schedule as possible. Exploit the full organization match or benefit sharing. Build up an arrangement and stick to it. Try not to respond to fleeting business sector good and bad times. Intend to spare 10 times your completion pay by age 67, as a dependable guideline.”

Tom Mingone, organizer of Capital Management Group, New York

“My best retirement guidance is: Design the life that you need, and afterward make sense of how the budgetary segment needs to function. So regularly I hear individuals say, ‘I will live some place less expensive when I resign. I don’t think I can bear to live here.’ If living here relies on upon what is essential, if your family is here, then staple goods cost the same, amusement costs the same. In the event that there is insufficient cash, consider exchanging down. Be that as it may, don’t give it a chance to control your life. Perhaps you live in a littler place. Isn’t that superior to having a greater house 10 hours away? Choose what is essential to you. Crunch the numbers, and we should check whether it works. On the off chance that it doesn’t work, then take a gander at penances and exchange offs.”

Christine Marcks, president, Prudential Retirement, Hartford, Conn.

“When we converse with retirees now, what they generally say is they ought to have begun before and spared more. That is an extremely steady recommendation retirees would offer their more youthful selves.”

Reid Abedeen, Safeguard Investment Advisory Group, Corona, Calif.

“Make a retirement pay arrange well before you plan to ¬retire. That will give you a smart thought of the amount you have to spare. Individuals who have done it will have the adaptability of when they need to resign. I have customers who could resign, yet they are appreciating work. These are their most elevated procuring years. They would prefer not to resign. I said if the earth changes or their wellbeing transforms, we can go to the arrangement. It is ameliorating to know they could leave today on the off chance that they need.”

David Blackston, Blackston Financial Advisory Group, The Villages, Fla

“Locate a Certified Financial Planner expert to help you comprehend where you are fiscally and where you need to be at retirement. Commonly we trust we can deal with something like painting our home ourselves to spare cash. We regularly take in the most difficult way possible that on the off chance that we had just employed an expert painter, we not just may have spared time and cash over the long haul however perhaps an outing to the crisis room. An expert will have the correct instruments to break down the circumstance and prescribe the best game-plan to take care of business successfully and effectively.

“What is your way of life going to be? Will you need to travel? Will you move? You must have an arrangement. In the event that you don’t, you plan to fizzle.”

Also Read Top Stories:

Table of Contents

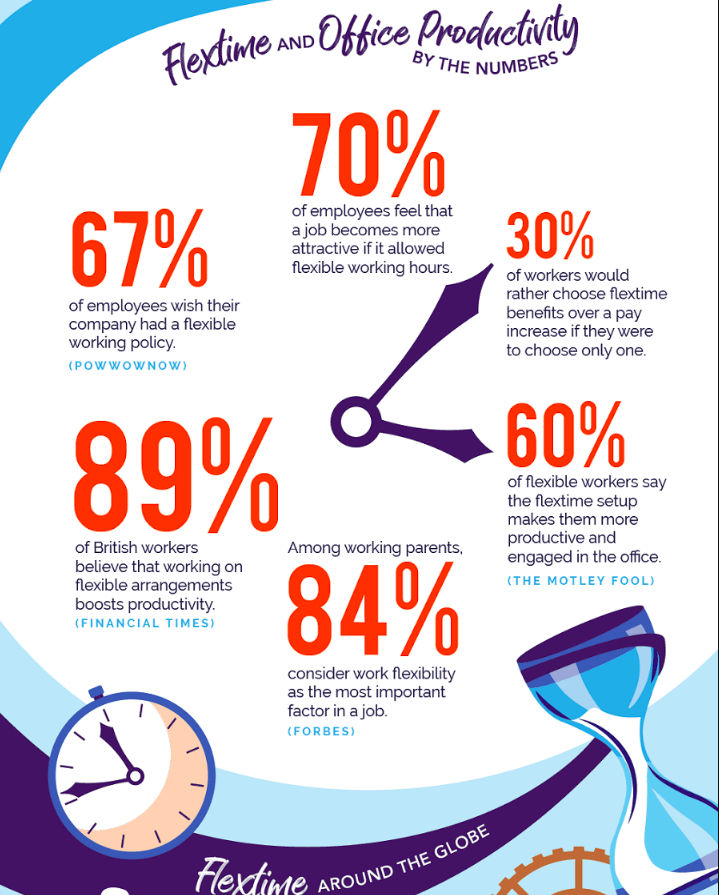

Creative Ways to Attract and Retain Top Employees

A happy employee is a productive employee. You can help your staff feel comfortable and valued in so many ways – and not just with a pay raise. Increasingly, individuals are looking for work that offers them a fantastic benefits package that keeps them feeling motivated. By implementing a few simple practices, you could increase…

6 Work Culture Trends We’re Looking Out For in 2021

The pandemic has changed everything, quite literally everything. While we’re sure you already have a great work culture in place, the COVID-19 pandemic has changed everything in the business world, including the worker-employer relationships. For organizations focusing on work culture, the shift to remote working means creating new strategies to support employees, manage a hybrid…