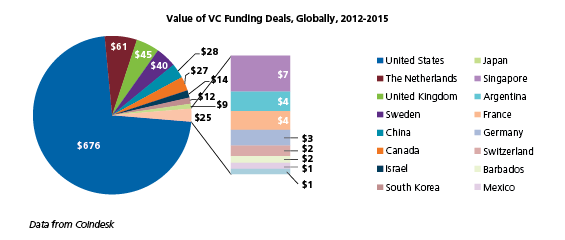

We’ve most likely heard the term venture capital around. In any case, what precisely does it mean? What is it and why do business people need it so severely?

In the realm of Silicon Valley essentially the startup capital of the universe business visionaries and dreamers live and inhale “VC.” That’s since investment is the money that dispatches new companies.

Table of Contents

VENTURE CAPITAL

A venture capital is monetary assets accommodated new companies. In other word “capital is cash and different assets accommodated another organization or for venture. A venture is an unsafe undertaking, similar to a startup.”

Financial specialists or investor give funding to new businesses and independent ventures that are accepted to have long haul development potential. Numerous new startups wouldn’t have transformed into the behemoths they are today notwithstanding funding.

In financial term those investors are known as venture capitalist, which puts resources into new businesses and high-development organizations in return for equity, or a share in the organization. Regularly VCs turn out to be actually required in their ventures.

TYPES OF FUNDING

There are really a few types of capital:

- Loans: Small scale Business loans can be a decent choice for a few new businesses that would not prefer to pay remarkably high loan interest & fees for their capital.

- Friends and family: The loved ones is most likely the least demanding approach to get cash, when your startup is moderately new, and gives an underlying infusion of money, ordinarily from individuals who are by one means or another associated with the business visionaries. These subsidizing rounds can run from $20,000 to $200,000.

- Angel speculators: Angel financial specialists are rich individuals who need to put resources into organizations and give seed subsidizing to business visionaries with extraordinary thoughts, yet normally don’t request the significant yields that VCs do. A blessed messenger normally puts resources into a developing organization before it gets to the VC level. The normal individual angel investor venture size is about $30,000.

A famous example for organization, which get funding through VC’s: Facebook, Uber, Snapchat, and many more. Traditionally, funds are coming in three investment rounds, which are Series A, B, C and fund range between $3 million to $5 million range

WHAT DO VC FIRMS?

Simply, VCs give a developing organization a huge amount of cash, but then the pressure is on to multiply that money so everyone gets a piece.

The arrival on investment differs, yet by and large as an end-result of financing one to two years of an organization’s start-up operations; investors hope to profit back 10 times over, in only five years’ chance. For instance, suppose Firm XYZ puts $10 million in Company ABC in 2012. Firm XYZ hopes to produce $100 million from their interest in Company XYZ by 2017.

Top Venture Capital (VC) Firms

There are so many VC firms out of there, But we are listing some of the very well known firms here. These list mentioned based on pure internet data not for promotion purpose, So if you are not hear about them then please do some research by yourself too through google and check their backgound and investment and others aspects. If all will fit for your requirement then go for it.

List of VC firms

- Accel

- Andreessen Horowitz

- Benchmark

- Bessmer Venture Partners

- Greycroft

- Index Ventures

- Sequoia Capital

- Bain Capital Venture

- Founders Fund

- GGV Capital

- Canaan Partners

- IVP

- Sequoia Capital China

- Anthemis

- Tiger Global Management

- General Catalyst

- TCV

- Bond

- Balderton Capital

- Lightspeed Venture Partners

- RRE Ventures

- First Round Capital

- GSR Ventures

- Qiming Venture Partners

- Floodgate

- Felicis Ventures

- Andreessen Horowitz

In case you have any suggestion for Venture Capital firms that should be included in this list then please let us know in the comment section or reach out to us on social media or shoot a mail to us at support@ganvwale.com.

“Best of luck to every one of you searching VC’s for funding, Congrats to all who have get funding, and thank you for visit our blog!”